About us

What is a Global Employer of Record

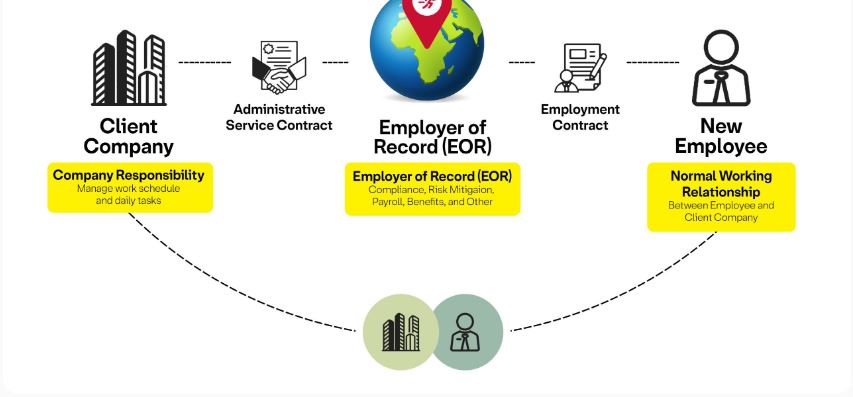

A Global Employer of Record (EOR) is a service that allows companies to hire employees in different countries without setting up a local legal entity. The EOR acts as the official employer, handling payroll, taxes, benefits, compliance, and other HR tasks on behalf of the client company. This simplifies international hiring by managing local labor laws and administrative duties, enabling businesses to quickly expand into new markets, hire remote workers, and access global talent with reduced legal risks. It’s an efficient solution for scaling a global workforce while focusing on core business activities.

What are some advantages of using an Employer of Record?

Simplifies Global Expansion:

An EOR enables businesses to hire employees in different countries without the need to set up a local legal entity, making it faster and easier to enter new markets.Ensures Legal Compliance:

EORs have expertise in local labor laws and regulations, ensuring that employment contracts, payroll, taxes, and benefits comply with legal requirements, reducing the risk of penalties or legal issues.Reduces Administrative Burden:

By handling HR tasks such as payroll processing, benefits administration, and employee onboarding, an EOR allows companies to focus on their core business activities.

Access to Global Talent:

Companies can hire the best talent from anywhere in the world, expanding their talent pool and gaining access to specialized skills without geographic limitations.Cost Efficiency:

Setting up a local entity in a foreign country can be costly and time-consuming. An EOR eliminates these expenses and streamlines the hiring process.Scalability and Flexibility:

EORs allow businesses to scale their workforce up or down based on changing needs, offering a flexible solution for temporary projects, seasonal hiring, or testing new markets.

Improved Employee Experience:

With local expertise, EORs can offer employees a smooth onboarding process and benefits package tailored to the specific country, enhancing employee satisfaction.

Why Global Hire Solutions?

Enhance Global Workforce Management: Provide seamless Employer of Record services to simplify international hiring and compliance.

Optimize Client Onboarding: Streamline the onboarding process to ensure quick and efficient integration of new hires across multiple countries.

Expand Geographic Footprint: Increase our presence in key international markets to support clients’ global expansion strategies.

Ensure Regulatory Compliance: Maintain up-to-date knowledge of local labor laws and regulations to guarantee full compliance for our clients.

Foster Client-Centric Solutions: Develop tailored EOR services that cater specifically to the unique needs of each client.

Promote Operational Efficiency: Utilize advanced technology to enhance the efficiency and effectiveness of our EOR services.

Drive Market Leadership: Establish Global EOR Solutions International as a trusted leader in the Employer of Record industry.

Global Coverage

Frequently Asked Questions (FAQs)

How does an Employer of Record (EOR) work

An Employer of Record (EOR) works by acting as the legal employer for your workers in a specific country. The EOR handles payroll, taxes, benefits, and compliance with local labor laws on your behalf, while you retain day-to-day control over the employees’ tasks and responsibilities. This allows your company to hire internationally without setting up a local entity, simplifying global expansion and reducing administrative burdens.

Employer of Record vs PEO?

An Employer of Record (EOR) and a Professional Employer Organization (PEO) both handle HR tasks but differ in key ways:

– EOR: Acts as the legal employer for international workers, managing payroll, taxes, benefits, and compliance in foreign countries without needing your company to establish a local entity. Ideal for global expansion.

– PEO: Shares HR responsibilities through co-employment but requires your company to have a legal entity. Primarily helps with payroll, benefits, and compliance within an existing market.

– Key Difference: EOR is best for international hiring without local entities, while PEO is for managing HR in countries where you’re already established.

How do you compare Employer of Record (EOR) services?

Global Coverage:

Ensure the EOR operates in the countries where you need to hire. The wider their coverage, the more flexibility you have for global expansion.

Compliance Expertise:

Look for an EOR with strong expertise in local labor laws and regulations to ensure full compliance with taxes, employment contracts, and benefits.

Cost Structure:

Compare pricing models, including any hidden fees or additional costs for services like payroll processing, benefits administration, or contract termination.

Service Offerings:

Evaluate the range of services provided (e.g., payroll, benefits, onboarding) and how customizable they are to your specific needs.

Technology and Integration:

Check if the EOR platform integrates with your HR or payroll systems and whether it offers user-friendly tools for managing international employees.

Is using an EOR Legal

using an Employer of Record (EOR) is legal in most countries, provided it operates in compliance with local labor laws and regulations. EORs specialize in understanding and adhering to the employment laws of different countries, ensuring that employees are hired, paid, and managed according to the legal standards of their location.

However, it’s important to choose a reputable EOR with expertise in the specific countries you are operating in, as labor regulations vary widely. A reliable EOR ensures full compliance with tax, payroll, and employment laws, helping businesses avoid legal risks while hiring internationally.

EOR in Payroll

In payroll, an Employer of Record (EOR) handles all payroll-related tasks for employees on behalf of the client company. This includes:

1. Salary Payments:

The EOR processes employee salaries in compliance with local tax laws and payment schedules, ensuring timely and accurate payments.2. Tax Withholding and Filing:

The EOR calculates and withholds the necessary income taxes, social security contributions, and other statutory deductions. They also handle the filing of these taxes with the relevant government authorities.3. Benefits Administration:

The EOR manages employee benefits such as health insurance, retirement plans, and other perks in line with local requirements.

Read More

Compliance: The EOR ensures that payroll is processed in full compliance with local labor laws, including minimum wage regulations, overtime pay, and other statutory requirements.

Reporting and Documentation: The EOR provides detailed payroll reports and maintains all necessary documentation to ensure compliance with tax authorities and labor regulations.

Using an EOR for payroll allows businesses to outsource the complexities of international payroll management, ensuring accuracy, legal compliance, and reducing administrative burden.